Batteries for Solar Plants in Spain 2026: BESS vs Flow Batteries - Which to Choose

Introduction

Hybridization of photovoltaic plants with storage systems (BESS: Battery Energy Storage Systems) has gone from being a technological curiosity to a viable commercial strategy in Spain. In 2026, more than 15% of new solar plants > 10 MW include BESS from initial design, and hundreds of existing plants are evaluating battery retrofits.

Why now? Three factors converge:

- Price drop: Li-ion battery cost has fallen from 600 €/kWh (2018) to 180-220 €/kWh (2026)

- Growing curtailment: Saturated zones (Extremadura, CLM) lose 5-10% annual production due to grid restrictions

- New service markets: Secondary regulation (aFRR) pays 50-150 €/MW/day, creating additional revenue

But which battery technology to choose? Li-ion NMC, LFP (lithium-iron-phosphate), or emerging flow batteries (redox flow batteries)? Each has advantages and disadvantages depending on your specific application: price arbitrage, curtailment capture, grid services, or self-consumption backup.

In this article, we’ll break down available storage technologies in 2026, compare CAPEX/OPEX, analyze optimal use cases, and present real cases of hybridized plants in Spain.

1. Taxonomy of storage technologies

Classification by chemistry

| Technology | 2026 Status | Market Share | Main Application |

|---|---|---|---|

| Li-ion NMC (Nickel-Manganese-Cobalt) | Mature | 40% | Utility-scale, high energy density |

| Li-ion LFP (Lithium-Iron-Phosphate) | Dominant | 55% | Utility-scale, long cycles |

| Flow Batteries (Vanadium Redox) | Emerging | 3% | Applications > 4h discharge |

| Na-ion (Sodium-ion) | Commercial pilot | < 1% | Low temperature, low cost |

| Solid-state | Laboratory | 0% | Post-2030 |

Clear trend: LFP has displaced NMC in solar plants for its higher safety and cycle life.

2. Li-ion LFP: The current standard

Technical characteristics

| Parameter | Value (2026) |

|---|---|

| Energy density | 150 - 180 Wh/kg |

| Cycle life (80% DoD) | 6,000 - 8,000 cycles |

| Round-trip efficiency | 88 - 92% |

| Annual degradation | 1.5 - 2.5% capacity/year |

| Useful life | 12 - 15 years (intensive use) |

| Operating temperature | -10°C to +55°C |

| Thermal risk | Very low (doesn’t suffer thermal runaway like NMC) |

Advantages

- Safety: Doesn’t contain cobalt (less fire risk)

- Long cycles: 6,000-8,000 cycles @ 80% DoD (vs 3,000-5,000 of NMC)

- Competitive cost: 180-220 €/kWh (complete system with BMS, PCS, container)

- Availability: CATL, BYD, EVE produce at large scale

Disadvantages

- Lower energy density: 20-30% less than NMC (more space needed)

- Cold performance: Loses efficiency < 0°C

- Calendar degradation: 1.5-2.5%/year even without cycling

Optimal use cases

- Price arbitrage (1-2 cycles/day)

- Curtailment capture (opportunistic discharge)

- Regulation services (aFRR, response < 1s)

- Plants 10-100 MW (economies of scale in containers)

3. Flow Batteries: The long-duration future

What are Flow Batteries?

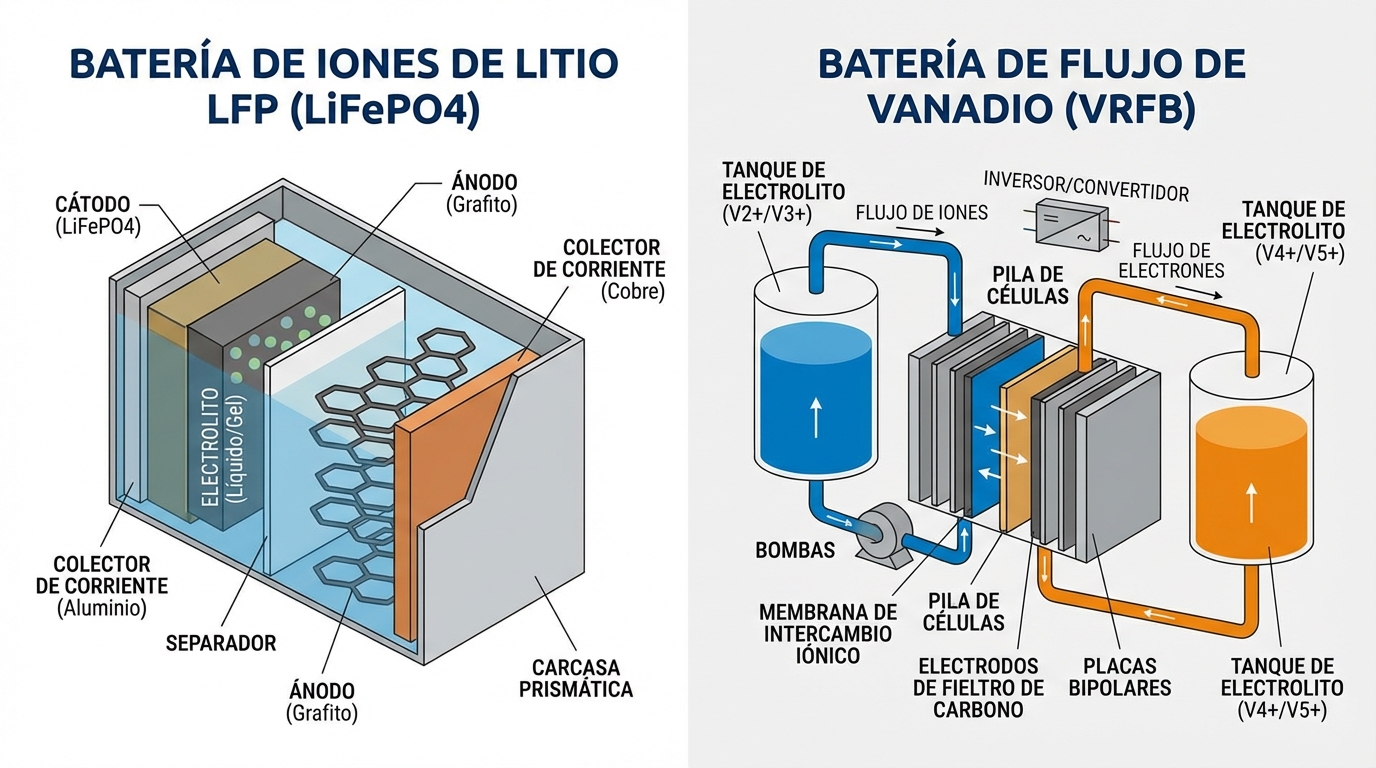

Unlike Li-ion (where energy and power are coupled in cells), flow batteries separate energy (liquid electrolyte in tanks) and power (electrochemical stack).

Key advantage

Independent scalability:

- Want more power (MW) → add more stacks

- Want more energy (MWh) → add more electrolyte tanks

Vanadium Redox Technology (VRFB)

| Parameter | Value (2026) |

|---|---|

| Energy density | 20 - 35 Wh/kg (very low vs Li-ion) |

| Cycle life | 15,000 - 20,000 (unlimited if replacing electrolyte) |

| Round-trip efficiency | 70 - 80% (lower than Li-ion) |

| Degradation | < 0.5%/year (almost none) |

| Useful life | 20 - 25 years |

| Optimal discharge duration | 4 - 10 hours |

Advantages

- Minimal degradation: Doesn’t lose capacity with cycles

- Absolute safety: Aqueous electrolyte (non-flammable)

- Extended lifespan: 20-25 years (vs 12-15 Li-ion)

- Scalability: Easy to add capacity (only tanks)

Disadvantages

- High CAPEX: 300-450 €/kWh (60-100% more expensive than LFP)

- Low energy density: Takes 3-5x more space than Li-ion

- Lower efficiency: 70-80% vs 90% LFP (lose more energy)

- Complexity: Requires pumping systems, electrolyte temperature control

Optimal use cases

- Seasonal storage (charge in spring, discharge in winter)

- Arbitrage with > 4h discharge (charge at night, discharge late afternoon-night)

- Critical systems (hospitals, datacenters) where lifespan > 20 years is key

- Projects with abundant space (no footprint limitation)

Why haven’t they taken off?

In 2026, flow batteries remain niche (3% market) because:

- Li-ion price has dropped faster than expected (300 €/kWh in 2020 → 200 €/kWh in 2026)

- Most solar applications need 1-4h discharge (Li-ion sufficient)

- 2x CAPEX of flow batteries not compensated by extended lifespan (due to money time discount)

Projection: Flow batteries will gain market post-2028 if Li-ion stagnates at 180-200 €/kWh.

4. Economic comparison: CAPEX and OPEX

CAPEX per kWh (complete system, 2026)

| Technology | CAPEX (€/kWh) | Breakdown |

|---|---|---|

| LFP (2 MW / 4 MWh container) | 200 | Cells: 110 / BMS: 30 / PCS: 40 / Container: 20 |

| NMC (2 MW / 3 MWh container) | 240 | Cells: 140 / BMS: 35 / PCS: 45 / Container: 20 |

| Flow Battery (500 kW / 4 MWh) | 380 | Stack: 150 / Electrolyte: 120 / Tanks: 60 / Pumps: 50 |

Note: Prices for purchases > 10 MWh (projects > 5 MW). Small projects pay 20-30% more.

Annual OPEX

| Concept | LFP (€/kWh/year) | Flow Battery (€/kWh/year) |

|---|---|---|

| Preventive maintenance | 5 | 8 |

| Insurance | 3 | 3 |

| Thermal management (HVAC) | 2 | 4 (pumping) |

| Component replacement | 4 (12-15 year lifespan) | 2 (20-25 year lifespan) |

| Total | 14 €/kWh/year | 17 €/kWh/year |

5. Business models: Arbitrage, grid services and curtailment

A. Price arbitrage (Energy Arbitrage)

Concept: Buy/store cheap energy (night, midday solar surplus) and sell expensive (late afternoon-night, demand peaks).

Typical example:

| Hour | Pool Price (€/MWh) | BESS Action |

|---|---|---|

| 03:00 | 25 | Charge from grid |

| 13:00 | 30 | Charge from panels (avoided curtailment) |

| 20:00 | 65 | Discharge to grid |

Annual revenue (10 MWp plant + 2 MW / 4 MWh BESS):

- Cycles/day: 1.5 (conservative)

- Price differential: 30 €/MWh (average)

- Cycled energy: 4 MWh × 1.5 × 365 = 2,190 MWh/year

- Gross revenue: 65,700 €/year

- Battery OPEX costs: 4,000 kWh × 14 €/kWh = 56,000 €/year

- Net revenue: 9,700 €/year (low, doesn’t justify investment with arbitrage alone)

Conclusion: In Spain (2026), pure arbitrage is NOT viable with current market prices (volatility has decreased vs 2022-2023).

B. Grid services (aFRR, mFRR)

aFRR (automatic Frequency Restoration Reserve): Automatic response to frequency deviations (< 1 second).

Revenue:

- Contracted capacity: 50-150 €/MW/day (according to monthly auction)

- Dispatched energy: 40-80 €/MWh (activations)

Example (2 MW BESS):

- Capacity contracted 50% of time: 100 €/MW/day × 2 MW × 182 days = 36,400 €/year

- Activations (50 MWh/year): 50 MWh × 60 €/MWh = 3,000 €/year

- Total: ~40,000 €/year

Requirements:

- Response time < 1s (Li-ion complies, flow batteries NO)

- Availability > 95%

- REE certification (6-12 month process)

C. Curtailment capture

Problem: In saturated zones (Extremadura, CLM), REE orders production reduction at solar peaks (midday).

BESS Solution: Store energy that would be curtailed and sell later.

Example (plant with 7% annual curtailment):

- Gross production: 17,500 MWh/year

- Curtailment without BESS: 1,225 MWh lost

- BESS captures 80%: 980 MWh stored

- Sold @ 40 €/MWh: 39,200 €/year

This IS a solid business case (8-10 year BESS payback).

Optimal combination: Revenue stacking

Winning strategy: Combine all 3 models

| Source | Annual Revenue (2 MW / 4 MWh BESS) |

|---|---|

| Opportunistic arbitrage | 10,000 € |

| aFRR services | 40,000 € |

| Curtailment capture | 39,000 € |

| Total | 89,000 €/year |

BESS CAPEX: 4 MWh × 200 €/kWh = 800,000 € Annual OPEX: 56,000 € Simple payback: 800,000 / (89,000 - 56,000) = 24 years (without degradation)

With degradation (2%/year):

- Year 1: 89,000 €

- Year 5: 81,000 €

- Year 10: 71,000 €

- Real payback: Doesn’t recover investment in useful life ❌

Hard conclusion: In 2026, BESS is only viable if:

- Curtailment > 8%/year (capture justifies investment)

- You receive subsidies (30-40% CAPEX)

- You expect price drop to < 150 €/kWh (post-2027)

6. Battery degradation and replacement

LFP degradation curve

Factors accelerating degradation:

| Factor | Impact on Degradation |

|---|---|

| High DoD (> 90%) | +30-50% degradation |

| Temperature > 35°C | +20-30% degradation |

| Fast cycles (C-rate > 1) | +15-25% degradation |

| Storage at 100% SoC | +10-15% degradation |

Mitigation strategy:

- Operate between 20-80% SoC (60% DoD) → extends life from 6,000 to 9,000 cycles

- Active HVAC (maintain < 30°C) → reduces degradation 20%

- Avoid cycles > 1C (charge/discharge in > 1 hour) → reduces stress

Degradation model

Example (LFP with 1.5 cycles/day):

- Cyclic degradation: 6,000 cycles × 1.5/day / 365 = 10.95 years to lose 20%

- Calendar degradation: 2%/year × 10.95 years = 21.9%

- Capacity @ year 11: ~60% (end of useful life)

Replacement cost: 110 €/kWh (cells only, without BMS/PCS) → 440,000 € for 4 MWh

Strategy: Most investors don’t replace (sell used battery for second life: electric vehicles, residential self-consumption).

7. Real hybridization cases in Spain

Case A: 50 MW plant + 10 MW / 20 MWh BESS (Badajoz, 2024)

Developer: Ignis Energia BESS Technology: LFP (CATL) Motivation: Chronic curtailment (9%/year)

Year 1 results (2025):

- Avoided curtailment: 4,500 MWh (50% of total, BESS capacity limitation)

- Curtailment revenue: 4,500 × 38 €/MWh = 171,000 €

- aFRR revenue: 85,000 €

- Total revenue: 256,000 €/year

- BESS CAPEX: 4.2 M€

- Payback: 16.4 years (marginal)

Lesson: Only viable because received 1.2 M€ subsidy (30% CAPEX) → Real payback: 11.8 years.

Case B: 20 MW plant + 4 MW / 8 MWh BESS (Ciudad Real, 2025)

Developer: Solaria Energia BESS Technology: LFP (BYD) Motivation: Designed from scratch to maximize revenue (not retrofit)

Strategy:

- DC/AC ratio: 1.35 (27 MWp DC / 20 MW AC) → capture clipping with BESS

- aFRR participation 80% of time

Year 1 results (2026):

- Captured clipping: 1,200 MWh

- Arbitrage: 400 MWh

- aFRR revenue: 180,000 €/year

- Total revenue: ~260,000 €/year

- BESS CAPEX: 1.7 M€

- Payback: 10.5 years (acceptable with subsidy)

Lesson: Designing plant from scratch with BESS allows optimizing DC/AC ratio and capturing more value.

Case C: 2 MW self-consumption + 500 kW / 1 MWh BESS (Madrid, industrial)

Client: Electronics component factory BESS Technology: LFP (EVE) Motivation: Reduce peak consumption (3.0TD tariff penalizes contracted power)

Results:

- Contracted power reduction: -25% (from 2.5 MW to 1.9 MW)

- Power term savings: 80,000 €/year

- Increased self-consumption: +15% (from 70% to 85%)

- Payback: 3.8 years (excellent)

Lesson: Industrial self-consumption with peak management is the best use case for BESS in Spain (2026).

8. Regulation and permits for BESS

Additional procedures

If adding BESS to existing plant:

| Procedure | Duration | Cost |

|---|---|---|

| Substantial AAU modification (Single Administrative Authorization) | 6-12 months | 15,000 - 30,000 € |

| Connection point update | 3-6 months | 5,000 - 15,000 € |

| BESS compatibility certificate (Grid Code compliance) | 2-4 months | 10,000 - 20,000 € |

| Industrial inspection | 1 month | 3,000 - 5,000 € |

Total: 8-16 months, 33,000 - 70,000 €

Regulatory limitations

Problem: In Spain (2026), no compensation mechanism for technical restrictions (curtailment) exists.

Implication: If REE orders curtailment, you don’t receive compensation. BESS allows you to capture that energy, but business case depends on selling it later (not direct compensation).

Comparison with other countries:

- Germany: Compensates 95% spot price for curtailment

- Italy: Compensates 100% in congestion zones

- Spain: 0% (you must assume cost)

Projection: Sector lobby seeks to introduce compensation in 2027-2028 (would improve BESS business case).

9. Main manufacturers and suppliers

Integrated BESS (Turnkey)

| Manufacturer | Technology | Typical Size | Spain Reference |

|---|---|---|---|

| CATL | LFP | 1-100 MW | 15+ projects |

| BYD | LFP | 0.5-50 MW | 20+ projects |

| Sungrow | LFP | 1-50 MW | 10+ projects |

| Tesla (Megapack) | LFP/NMC | 2-100 MW | 3 projects (expensive) |

| Fluence | LFP (partnerships) | 10-200 MW | 5+ projects |

Flow Battery suppliers

| Manufacturer | Technology | Status |

|---|---|---|

| ESS Inc. | Iron flow | Commercial USA, pilot Spain |

| Invinity | Vanadium Redox | Pilot UK/Australia |

| Sumitomo | Vanadium Redox | Commercial Japan |

Availability in Spain: Limited (only pilot projects < 5 MWh).

10. Conclusion: BESS in Spain 2026 - Is it worth it?

Short answer: It depends.

BESS is worth it if:

- Curtailment > 8%/year (lost energy capture justifies investment)

- You receive subsidy (30-40% CAPEX from hybridization programs)

- Industrial self-consumption with high demand peaks (contracted power management)

- aFRR participation (grid service revenue)

- You expect price drop to < 150 €/kWh (post-2027) and can wait

BESS is NOT worth it if:

- Plant without curtailment (< 2%/year) and no subsidy

- Price arbitrage only (insufficient volatility in 2026)

- Small project (< 5 MW) where economies of scale don’t apply

- Expensive financing (if debt > 6%, payback extends > 15 years)

Recommended technology:

- Utility-scale (1-4h discharge): LFP (BYD, CATL)

- Long duration (> 4h): Wait for flow batteries post-2027 (still expensive)

- Industrial self-consumption: LFP (EVE, Sungrow)

Projection 2026-2030:

- LFP price will drop to 120-150 €/kWh → payback < 8 years

- Flow batteries will reach 250-300 €/kWh → compete in > 6h discharge

- Spanish regulation will introduce curtailment compensation → improve business case 30%

Final recommendation: If you have curtailment > 8% and can access subsidies, install BESS now. If not, wait 18-24 months (prices will continue dropping).

Need to simulate BESS business case for your plant? 👉 Use our BESS viability calculator

Want to compare BESS supplier offers? Contact us to connect with certified integrators