Solar Plant Secondary Market: How to Value and Sell Photovoltaic Assets in Spain

Introduction

The secondary market for photovoltaic assets in Spain has experienced explosive growth since 2020. If in 2015-2018 only €200-300M annually closed in operational plant transactions, in 2025 volume exceeded €3,500M, with more than 4 GW of capacity changing hands.

Why this boom? Several factors converge:

- Market maturity: Thousands of plants with > 5 years of operational history (reliable data for valuation)

- Infrastructure funds: International capital seeks low-risk assets with 7-10% returns

- Professionalized developers: “Build-to-sell” business model (build and sell at COD)

- Refinancing pressure: Plants financed in 2018-2020 with expensive debt seek to refinance or sell

For an asset manager, understanding how these transactions are valued and negotiated is critical whether you’re a seller (maximize price) or buyer (avoid overpaying). In this article, we’ll break down standard valuation multiples, factors that add or subtract value, the typical M&A process, and 2025-2026 price trends.

1. Fundamentals of photovoltaic asset valuation

Valuation methods

| Method | Description | Primary Use |

|---|---|---|

| DCF (Discounted Cash Flow) | Projection of discounted future cash flows | Technical valuation (banks, funds) |

| EBITDA Multiple | Enterprise Value / EBITDA | Quick market comparison |

| €/MWp installed | Enterprise Value / Installed power | Benchmark by technology/zone |

| Revenue multiple | Enterprise Value / Annual revenue | Less used (doesn’t reflect profitability) |

In practice, deals are negotiated in EBITDA multiples, but validated with DCF.

Enterprise Value (EV) formula

Example:

- Share purchase price (equity): €15M

- Existing debt: €8M

- Cash on balance: €0.5M

- EV = 15 + 8 - 0.5 = €22.5M

Important: Transactions are negotiated in EV terms (buyer assumes debt).

2. EBITDA multiples in Spain (2025-2026)

Range by asset type

| Asset Type | EBITDA Multiple (EV/EBITDA) | Comment |

|---|---|---|

| Merchant (no PPA) | 6.0 - 8.0x | Exposure to market volatility |

| Short-term PPA (< 5 years) | 7.0 - 9.0x | Limited stability |

| Medium-term PPA (5-10 years) | 8.5 - 11.0x | Market standard |

| Long-term PPA (> 10 years) | 10.0 - 13.0x | Premium for visibility |

| PPA with investment grade off-taker | 11.0 - 14.0x | Maximum value (minimal counterparty risk) |

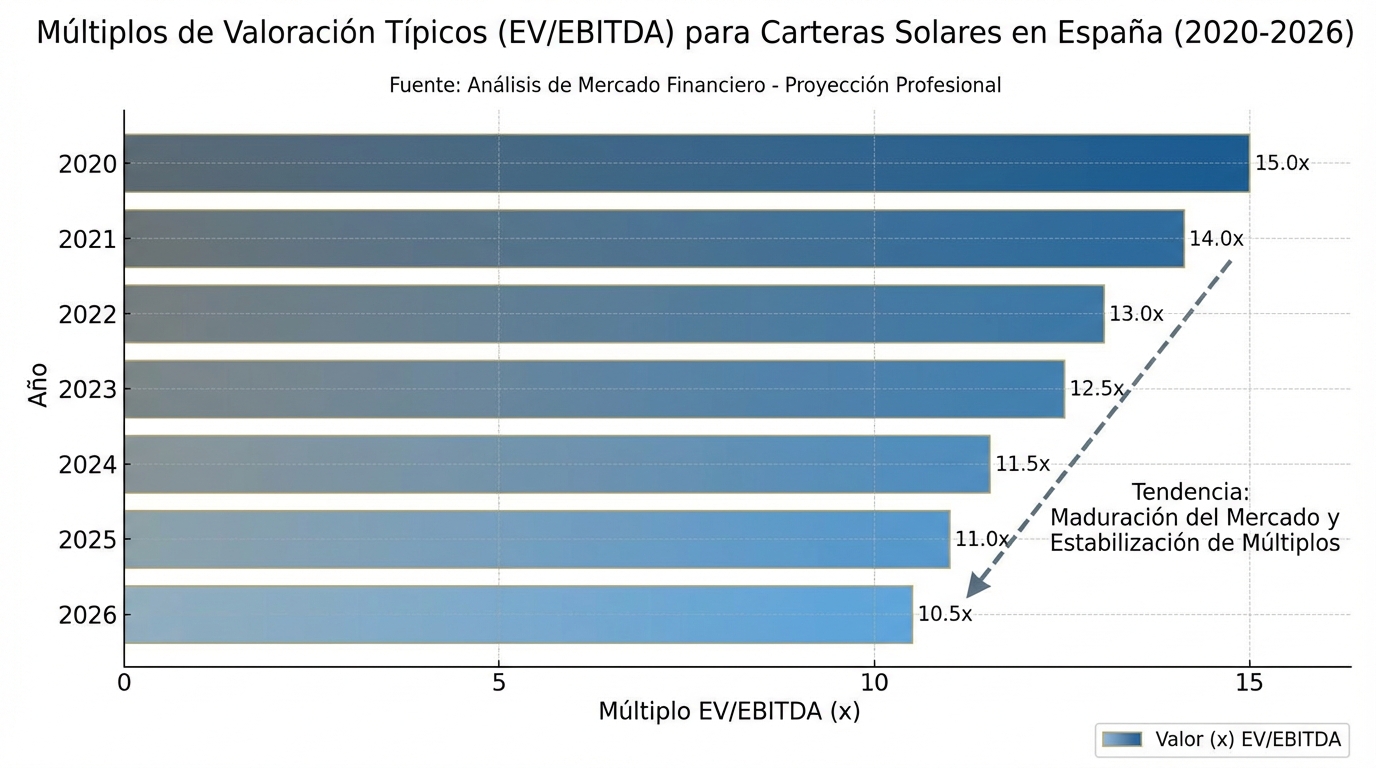

2025-2026 Trend: Multiples have compressed slightly vs 2023-2024 (when they touched 12-15x) due to:

- Greater asset supply

- Rising interest rates (higher cost of capital)

- Competition among sellers

Factors that modify the multiple

Positive factors (+1 to +3x):

| Factor | Impact on Multiple |

|---|---|

| PPA > 10 years with BBB+ off-taker | +2.0 - 3.0x |

| Plant < 3 years (modern technology) | +0.5 - 1.0x |

| Performance Ratio > 82% (historical) | +0.5 - 1.0x |

| Location in high irradiance zone (Andalusia) | +0.3 - 0.5x |

| O&M contract with Tier 1 manufacturer | +0.3 - 0.5x |

| Low curtailment (< 1% historical) | +0.5 - 0.8x |

Negative factors (-1 to -3x):

| Factor | Impact on Multiple |

|---|---|

| PPA expiration in < 2 years | -1.5 - 2.0x |

| Land contract < 15 years remaining | -1.0 - 2.0x |

| Chronic curtailment (> 5% annual) | -1.5 - 2.5x |

| Equipment out of warranty (> 10 years) | -0.8 - 1.2x |

| Performance Ratio < 75% | -1.5 - 3.0x |

| Pending litigation (permits, connection) | -2.0 - 4.0x |

3. Valuation by €/MWp: Geographic benchmark

Typical 2025-2026 prices

| Zone | €/MWp (EV) | Range | Typical Production (kWh/kWp) |

|---|---|---|---|

| Andalusia | 950,000 - 1,100,000 | High | 1,750 - 1,850 |

| Extremadura | 900,000 - 1,050,000 | Medium-High | 1,700 - 1,800 |

| Castilla-La Mancha | 850,000 - 1,000,000 | Medium | 1,650 - 1,750 |

| Aragón | 800,000 - 950,000 | Medium | 1,550 - 1,650 |

| Galicia | 650,000 - 800,000 | Low | 1,300 - 1,400 |

Note: Prices assume plant with 8-10 year PPA, 3-5 years operation, PR > 80%.

Calculation example

25 MWp Plant in Seville:

- Benchmark: €1,000,000/MWp

- Estimated EV: €25M

Validation with EBITDA:

- Annual production: 43,750 MWh (1,750 kWh/kWp)

- Revenue (PPA €40/MWh): €1,750,000

- OPEX: €200,000 (€8/kWp)

- EBITDA: €1,550,000

- EV / EBITDA: €25M / €1.55M = 16.1x

Interpretation: 16x multiple is high (implies > 10 years remaining PPA or very aggressive buyer).

4. Typical M&A transaction process

Timeline (6-12 months)

Phase 1: Preparation (2-3 months)

| Action | Responsible | Deliverable |

|---|---|---|

| Teaser (1 page) | Seller + M&A advisor | Anonymous asset description |

| Target buyer list | M&A advisor | 20-30 funds/companies |

| Data room preparation | Seller | 150-300 scanned documents |

| Indicative Bids (IOI) | Buyers | Non-binding price range |

Phase 2: Due Diligence (2-4 months)

| DD Type | Duration | Typical Cost |

|---|---|---|

| Technical | 4-6 weeks | €40,000 - 80,000 |

| Legal | 3-4 weeks | €30,000 - 60,000 |

| Financial | 2-3 weeks | €20,000 - 40,000 |

| Environmental | 2 weeks | €10,000 - 20,000 |

| Insurance | 1-2 weeks | €5,000 - 10,000 |

Phase 3: Negotiation (1-2 months)

- Binding Offer

- Share Purchase Agreement (SPA) draft

- Warranties negotiation (seller guarantees)

- Price adjustments negotiation

- Escrow agreements (guarantee funds)

Phase 4: Closing (1 month)

- SPA signing

- Obtaining conditions precedent (regulatory approvals)

- Financial closing (payment)

- SPV transfer (owner company)

5. Transaction structures

A. Share Deal (Purchase of SPV shares)

Description: Buy 100% of shares of company that owns the plant.

Advantages:

- Permits and contracts don’t change owner (simplifies procedures)

- Tax advantage: doesn’t pay ITP (Property Transfer Tax)

Disadvantages:

- Buyer assumes hidden liabilities of company

- Requires extensive warranties from seller

Use: 90% of transactions

B. Asset Deal (Asset purchase)

Description: Buy assets (panels, inverters, permits) without acquiring company.

Advantages:

- Don’t inherit company liabilities

- Cleaner accounting

Disadvantages:

- ITP: 4-6% of value (depending on region)

- Permits and contracts must be transferred (slow and complex)

Use: Rare (< 10% transactions)

C. Forward Purchase Agreement (FPA)

Description: Buy plant under construction, with closing at future date (COD).

Advantages (for seller/developer):

- Capital secured before building

- Reduces construction risk (buyer often assumes cost overruns)

Advantages (for buyer):

- Price fixed before (can be discount vs secondary market)

- Control over technical specifications

Use: Common in plants > 50 MW with institutional buyers

6. Secondary market agents

Buyers (Buy-side)

| Type | Typical Deal Size | Investment Horizon | Target IRR |

|---|---|---|---|

| Infrastructure funds | €50-500M | 15-25 years | 7-10% |

| Utilities (Iberdrola, Endesa, etc.) | €20-200M | Indefinite | 8-12% |

| Family Offices | €5-50M | 10-20 years | 10-15% |

| Private Equity | €30-300M | 5-7 years (exit) | 15-20% |

| Listed Yieldcos | €50-300M | Indefinite | 8-11% |

Main funds active in Spain (2025-2026):

- Qualitas Energy

- Q-Energy

- Copenhagen Infrastructure Partners (CIP)

- Glennmont Partners

- AMP Capital

- PGGM

Sellers (Sell-side)

| Profile | Sale Reason |

|---|---|

| Build-to-sell developers | Business model (capital rotates quickly) |

| PE funds in exit | End of investment period (5-7 years) |

| Companies refinancing | Liquidity need or divestment |

| Opportunistic investors | Take advantage of high market prices |

M&A Advisors

Top advisors in Spain:

- Alantra (Solar M&A)

- EY Transaction Advisory

- PwC Deals

- Deloitte Financial Advisory

- Oaklins

Typical commissions: 1.5-3% of EV (decreasing scale by deal size)

7. Price trends 2023-2026

Multiple evolution

| Year | Average EV/EBITDA | Average €/MWp | Comment |

|---|---|---|---|

| 2021 | 10.5x | €750,000 | Post-COVID boom |

| 2022 | 12.0x | €850,000 | Energy crisis → high pool prices |

| 2023 | 13.5x | €950,000 | Market peak |

| 2024 | 11.0x | €880,000 | Correction (pool normalization) |

| 2025 | 9.5x | €820,000 | Multiple compression |

| 2026 (projection) | 9.0x | €800,000 | Stabilization |

2023-2026 fall drivers:

- Pool price normalization: From €80-100/MWh (2022) to €40-50/MWh (2025)

- Rising interest rates: From 0% (2020-2021) to 4% (2023-2026) → higher WACC

- Greater asset supply: 5 GW/year entering operation (buyer saturation)

- Growing curtailment: Saturated zones (Extremadura, CLM) lose value

8. Real transaction cases

Case A: 300 MW Portfolio (2024, Extremadura)

Seller: Spanish developer (build-to-sell) Buyer: European infrastructure fund Assets: 6 plants (50 MW average each) Characteristics:

- COD: 2022-2023

- PPA: 10 years @ €42/MWh

- PR: 81-83%

Valuation:

- Total EV: €270M

- €/MWp: €900,000

- Annual EBITDA: €24M

- EV/EBITDA: 11.25x

Structure: Share deal, 100% payment at closing

Case B: 75 MW Plant (2025, Andalusia)

Seller: Spanish utility (divestment) Buyer: European Yieldco Characteristics:

- COD: 2020

- Merchant (no PPA)

- PR: 82.5%

- Curtailment history: 1.2%/year

Valuation:

- EV: €60M

- €/MWp: €800,000

- Annual EBITDA (3-year average): €8.5M

- EV/EBITDA: 7.05x

Structure: Share deal, €3M escrow (5%) for warranties for 18 months

Comment: Low multiple reflects spot market exposure (no PPA).

Case C: 15 MW Plant (2025, Castilla-La Mancha)

Seller: Family office Buyer: Private equity Characteristics:

- COD: 2018

- PPA expires in 2027 (2 years remaining)

- PR: 78% (low, historical inverter problems)

- Curtailment: 6%/year (saturated zone)

Valuation:

- EV: €9M

- €/MWp: €600,000 (low vs market)

- Annual EBITDA: €1.8M

- EV/EBITDA: 5.0x

Price adjustments:

- -15% for short PPA

- -10% for low PR

- -8% for high curtailment

- Total discount: -33% vs benchmark

Structure: €1.5M escrow for defective inverter replacement

9. Strategies to maximize value in sale

For sellers

1. Optimal timing

- Year 3-5 post-COD: Sufficient operational history to validate performance, but equipment still under warranty

- Before PPA expiration: If PPA expires in < 2 years, renegotiate before selling

- Avoid selling in Q4: Buyers usually have exhausted budgets (better Q1-Q2)

2. Pre-sale preparation (6-12 months before)

| Action | Impact on Valuation |

|---|---|

| Renew O&M contract (if expiring soon) | +3-5% |

| Repair defective equipment (improve PR) | +5-10% |

| Obtain low curtailment certificate (from REE) | +3-5% |

| Renew land lease (if < 15 years) | +5-8% |

| Independent technical audit | +2-3% (credibility) |

3. Asset marketing

- Professional teaser: Hire M&A advisor (commission recovers with surplus)

- Maximize competition: Minimum 5-7 buyers in process (generates price tension)

- Controlled auction: Better than bilateral (can raise price 10-15%)

For buyers

1. Risk analysis

- Confirm real history: Request full SCADA access (not just summaries)

- Validate capture price: Cross hourly production with OMIE prices (detect revenue inflation)

- Verify curtailment: Request REE emails/notifications (not just aggregate data)

2. Warranty negotiation

Critical warranties (seller responsibility post-closing):

| Warranty | Typical Duration | Cap (Liability Limit) |

|---|---|---|

| Minimum production | 2-3 years | 10-20% of price |

| Minimum PR | 2 years | 5-10% of price |

| Absence of hidden defects | 18 months | 5% of price |

| Legal compliance | No time limit | 100% of price |

Strategy: Demand broad warranties if due diligence found red flags.

3. Escrow structuring

- Typical escrow: 5-10% of price retained 12-24 months

- Use: Cover warranty claims or necessary repairs

10. Conclusion: A mature market but with opportunities

The secondary market for photovoltaic plants in Spain has gone from being a niche (2015-2019) to a mature and liquid segment (2025-2026), with transactions of > €3,500M annually.

Key conclusions:

- Multiples have compressed (from 13-14x in 2023 to 9-10x in 2026), but remain attractive for sellers who bought/built with low CAPEX

- Long PPAs still rule: Valuation difference can be 3-5x EBITDA between merchant and PPA > 10 years

- Due diligence is critical: Superficial DD can cost you 10-20% of value (hidden problems)

- Timing is key: Selling in year 3-5 post-COD maximizes value (history + active warranties)

2026-2028 Projections:

- Transaction volume will remain (€3,000-4,000M/year)

- Multiples will stabilize at 8.5-10x for assets with PPA

- Plants with chronic curtailment will see growing discounts (up to -30%)

- Repowering will create new wave of transactions (2010-2015 plants with obsolete technology)

Are you considering selling your plant or portfolio? 👉 Contact us