Solar Panel Technology Comparison 2026: Monocrystalline vs Bifacial vs Perovskite

Introduction

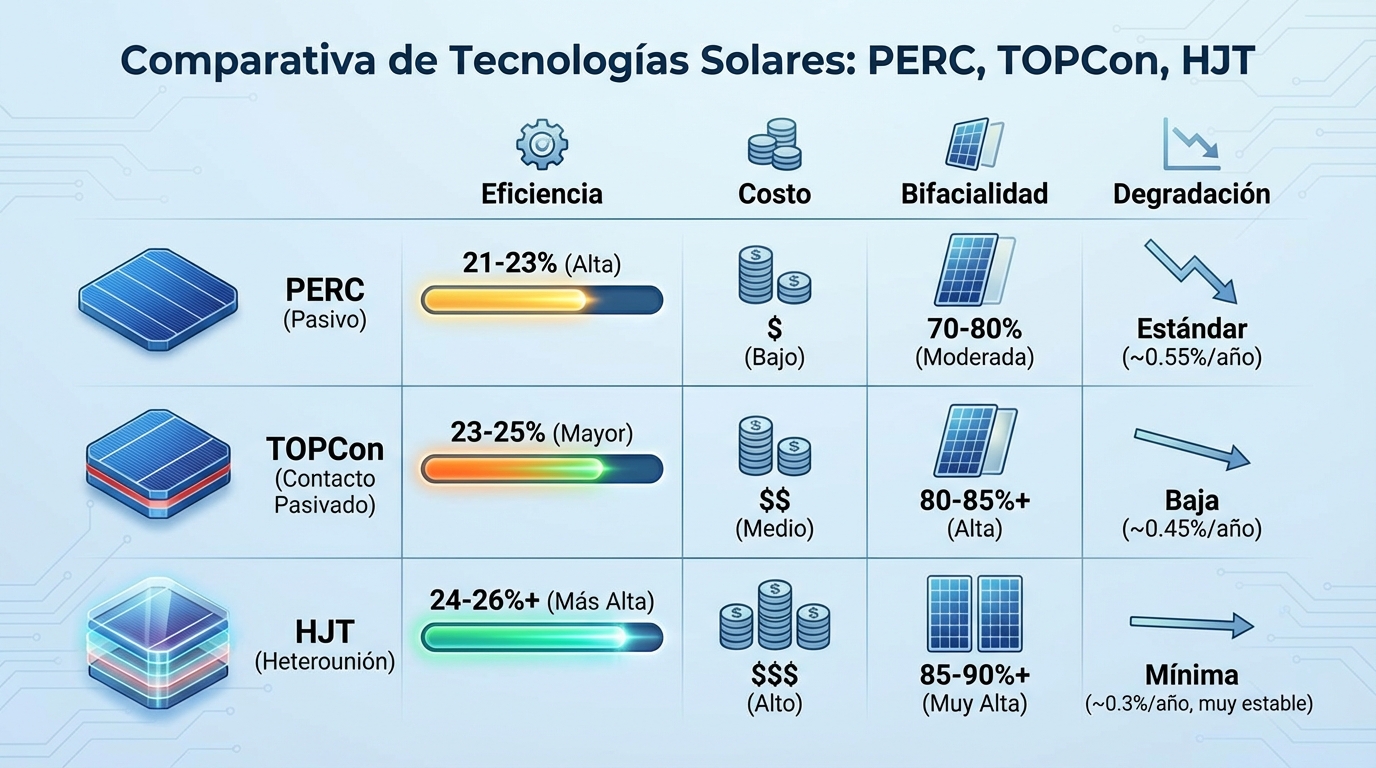

In 2026, the solar panel industry has reached unprecedented technological maturity. Monocrystalline silicon panels dominate the market with commercial efficiencies of 22-24%, but alternative technologies such as bifacials, heterojunction (HJT), and emerging perovskite cells are gaining ground in specific applications.

For a project developer or asset manager, choosing the right technology is not trivial: the difference between a standard monocrystalline panel and a bifacial HJT can be 50-80 €/kWp in CAPEX, but also +8-12% in annual production. When is it worth paying the premium? Which technology best suits your specific project?

In this article, we conduct an exhaustive technical and economic comparison of the main panel technologies available in 2026, analyze optimal use cases for each, and explore emerging technologies that could revolutionize the sector in the next 5 years.

1. Taxonomy of photovoltaic technologies 2026

Technology tree

Photovoltaic Panels

├── Crystalline Silicon (c-Si) ► 95% of market

│ ├── Monocrystalline (mono-Si)

│ │ ├── PERC (Passivated Emitter Rear Cell) ► Current standard

│ │ ├── TOPCon (Tunnel Oxide Passivated Contact) ► High efficiency

│ │ └── HJT (Heterojunction) ► Premium

│ └── Polycrystalline (multi-Si) ◄ Obsolete (< 1% in 2026)

│

├── Bifacial ► Monocrystalline with rear capture

│ ├── Bifacial PERC

│ └── Bifacial HJT ► Higher bifaciality

│

├── Thin-Film ► 3% of market

│ ├── CdTe (Cadmium Telluride)

│ ├── CIGS (Copper-Indium-Gallium-Selenium)

│ └── Amorphous Silicon (a-Si) ◄ Obsolete

│

└── Emerging Technologies ► < 1% commercial (2026)

├── Perovskite

├── Tandem Cells (perovskite + silicon)

└── III-V Cells (GaAs) ► Space/CPV only2. Monocrystalline PERC: The market standard

Technical characteristics

| Parameter | Value (2026) |

|---|---|

| Cell efficiency | 22.5 - 23.5% |

| Module efficiency | 20.5 - 22.0% |

| Typical power | 550 - 600 Wp (72-cell / 144-half-cell) |

| Temperature coefficient | -0.35%/°C |

| Year 1 degradation | 2% |

| Annual degradation | 0.45 - 0.55% |

| Power warranty | 87% @ 25 years |

| Product warranty | 12 - 15 years |

Advantages

- Competitive price: 0.18 - 0.22 €/Wp (panel only, purchase > 10 MW)

- Availability: All Tier 1 manufacturers produce PERC

- Maturity: Proven technology with > 10 years of track record

- Bankability: Banks and insurers know the risk well

Disadvantages

- Medium efficiency: Surpassed by TOPCon/HJT in performance

- Temperature coefficient: Worse than HJT in hot climates

- Limited bifaciality: Only 70-75% in bifacial versions

Optimal use cases

- Standard utility-scale plants (> 10 MW)

- Budget-constrained projects (CAPEX priority)

- Medium-high irradiance zones (Andalusia, Extremadura)

Main manufacturers

- LONGi (Hi-MO 5)

- JinkoSolar (Tiger Neo)

- Trina Solar (Vertex S)

- Canadian Solar (HiKu6)

3. TOPCon: The new high-efficiency generation

What is TOPCon?

TOPCon (Tunnel Oxide Passivated Contact) is an evolution of PERC that adds an ultra-thin oxide layer and passivated contacts, reducing electron recombination and increasing efficiency.

Technical characteristics

| Parameter | Value (2026) | Difference vs PERC |

|---|---|---|

| Cell efficiency | 24.0 - 25.0% | +1.5% |

| Module efficiency | 21.5 - 23.0% | +1.5% |

| Typical power | 600 - 650 Wp | +50 Wp |

| Temperature coefficient | -0.30%/°C | +0.05%/°C |

| Annual degradation | 0.40 - 0.45% | -0.10%/year |

| Power warranty | 88.5% @ 25 years | +1.5% |

Advantages

- Higher efficiency: 1-1.5% absolute vs PERC (= more kWh/m²)

- Better at high temperatures: Improved thermal coefficient

- Lower degradation: More production long-term

- Superior bifaciality: 75-80% (vs 70-75% bifacial PERC)

Disadvantages

- Premium price: +8-12% vs PERC (0.20 - 0.24 €/Wp)

- Lower availability: Not all manufacturers produce it

- More complex processes: More manufacturing steps = higher quality risk

Optimal use cases

- Space-constrained plants (maximize kWp/m²)

- High temperature zones (Seville, Córdoba in summer)

- Long-term PPA projects (value 25-year production)

Main manufacturers

- JinkoSolar (Tiger Neo N-type)

- Trina Solar (Vertex N)

- JA Solar (DeepBlue 3.0 Pro)

4. HJT (Heterojunction): The market premium

What is HJT?

HJT combines crystalline silicon (c-Si) with amorphous silicon (a-Si) layers on the front and rear, creating a “heterojunction” that drastically reduces carrier recombination.

Technical characteristics

| Parameter | Value (2026) | Difference vs PERC |

|---|---|---|

| Cell efficiency | 25.0 - 26.0% | +2.5% |

| Module efficiency | 22.5 - 24.0% | +2.5% |

| Typical power | 650 - 700 Wp | +100 Wp |

| Temperature coefficient | -0.25%/°C | +0.10%/°C ⭐ |

| Annual degradation | 0.25 - 0.35% | -0.20%/year ⭐ |

| Power warranty | 90.5% @ 25 years | +3.5% |

| Bifaciality | 85 - 95% | +15-20% ⭐ |

Advantages

- Maximum commercial efficiency: 22-24% at module level

- Excellent at high temperatures: Loss only 0.25%/°C

- Minimum degradation: Best long-term performance

- Superior bifaciality: 90-95% (vs 70-80% other technologies)

- Low-temperature processes: Lower carbon footprint

Disadvantages

- High price: +20-30% vs PERC (0.24 - 0.28 €/Wp)

- Limited production: Few large-scale manufacturers

- Supply chain: Higher risk of shortages

Optimal use cases

- Premium bifacial plants (elevated structures, high albedo)

- Very hot climates (temperature > 35°C frequent)

- Maximum space-constrained projects (industrial roofs)

- 25+ year vision investors (higher residual value)

Main manufacturers

- Huasun (Himalaya G12)

- REC Solar (Alpha Pure-R)

- Meyer Burger (White)

5. Bifacial: Double-sided, double production?

Operating principle

Bifacial panels capture solar radiation on both sides:

- Front side: Direct + diffuse irradiance (like standard panel)

- Rear side: Ground-reflected radiation (albedo) + sky diffuse

Bifaciality factor

| Technology | Bifaciality |

|---|---|

| Bifacial PERC | 70 - 75% |

| Bifacial TOPCon | 75 - 80% |

| Bifacial HJT | 85 - 95% |

Expected energy gain

The gain depends on multiple factors:

Example:

- HJT panel (90% bifaciality)

- Ground albedo 25% (white gravel)

- Rear view factor 70% (1.5m height)

- Gain: 90% × 25% × 70% ≈ 15.8%

Gain table by surface

| Surface Type | Albedo | Gain with PERC | Gain with HJT |

|---|---|---|---|

| Dark asphalt | 10% | +5% | +7% |

| Soil/grass | 15% | +8% | +11% |

| Gravel/sand | 25% | +13% | +18% |

| Light concrete | 35% | +18% | +25% |

| Snow | 70% | +37% | +50% |

Installation requirements

To maximize bifacial gain:

- Minimum height: 1.0 - 1.5 m above ground

- Structure transparency: Avoid rear shadowing from profiles

- Light surface: Consider installing white gravel

- Row spacing: Greater pitch reduces rear self-shading

Additional costs

| Item | Additional Cost |

|---|---|

| Bifacial panels | +5-10% vs monofacial |

| Elevated structures | +15-25 €/kWp |

| White gravel | 8-12 €/m² |

| Total | +30-50 €/kWp |

ROI: If gain is > 12%, additional payback is usually < 3 years.

6. Thin-Film (CdTe, CIGS): Niche and declining

CdTe (Cadmium Telluride)

Main manufacturer: First Solar (Series 7)

| Parameter | Value |

|---|---|

| Module efficiency | 18.5 - 19.5% |

| Cost | 0.16 - 0.18 €/Wp |

| Advantage | Better high-temperature performance than c-Si |

| Disadvantage | Perceived cadmium toxicity (requires specialized recycling) |

Current use: < 2% of market, mainly in USA

CIGS (Copper-Indium-Gallium-Selenium)

Manufacturers: Solar Frontier (closed in 2023), Solibro

| Parameter | Value |

|---|---|

| Module efficiency | 17.0 - 18.5% |

| Flexibility | Can be flexible (special applications) |

| Market | < 0.5% (nearly extinct in 2026) |

Why are they declining?

- Non-competitive efficiency: 18-19% vs 22-24% of c-Si

- Economies of scale: c-Si price has dropped so much that thin-film lost advantage

- Supply chain: Rare materials (indium, tellurium) vs abundant silicon

Conclusion: In 2026, thin-film only makes sense in niche applications (architectural integration, required flexibility).

7. Emerging technologies: Perovskite and Tandem

Perovskite: The promise since 2012

Status in 2026: Limited commercial prototypes, not yet mainstream

| Parameter | Value (Lab) | Commercial Value (2026) |

|---|---|---|

| Cell efficiency | 26.1% (2025 record) | 20 - 22% |

| Theoretical cost | 0.10 - 0.12 €/Wp | 0.22 - 0.26 €/Wp (current) |

| Stability | 20 years (projected) | 10 years (certified) |

Advantages:

- Simple manufacturing: Room-temperature printing processes

- Cheap materials: Abundant organic-inorganic precursors

- Flexibility: Can be applied on flexible substrates

Disadvantages (why it’s not in mass market):

- Accelerated degradation: Sensitive to humidity and temperature

- Critical encapsulation: Requires perfect moisture barriers

- Certification: Still doesn’t meet full IEC 61215 in extreme conditions

- Lead toxicity: Pb versions require environmental management

Pilot manufacturers:

- Oxford PV (limited commercial tandem cells)

- Saule Technologies (Poland, building applications)

- Microquanta (China, ramping up)

Tandem Cells (Perovskite + Silicon)

Concept: Stack perovskite cell (captures blue/green light) on silicon cell (captures red/IR light) to overcome Shockley-Queisser limit.

| Parameter | Value (2026) |

|---|---|

| Lab record efficiency | 33.9% (2025) |

| Commercial efficiency | 26 - 28% (prototypes) |

| Expected cost 2028 | 0.20 - 0.24 €/Wp |

Advantage: Potential for efficiencies > 30% in mass production (vs 24% of HJT).

Expected timeline:

- 2026: First pilot plants (< 100 MW global)

- 2027-2028: Production ramp-up (volume still < 1% market)

- 2030: Potential 5-10% market share if stability is confirmed

8. Economic comparison: Which to choose?

LCOE Analysis (Levelized Cost of Energy)

10 MWp plant in Seville (GHI 1,950 kWh/m²/year)

| Technology | CAPEX (€/Wp) | Production (kWh/kWp) | LCOE (€/MWh) | Ranking |

|---|---|---|---|---|

| Mono PERC | 0.55 | 1,750 | 31.4 | 🥉 3rd |

| TOPCon | 0.59 | 1,820 | 30.8 | 🥈 2nd |

| Bifacial HJT | 0.64 | 1,950 | 30.2 | 🥇 1st |

| Bifacial PERC | 0.58 | 1,860 | 30.5 | 2nd-3rd |

Conclusion: Bifacial HJT has the lowest LCOE despite higher CAPEX, due to superior production.

Sensitivity analysis: When is HJT not worth it?

Scenario 1: Low irradiance (Galicia, GHI 1,400 kWh/m²/year)

| Technology | Production (kWh/kWp) | LCOE (€/MWh) |

|---|---|---|

| Mono PERC | 1,400 | 39.3 |

| Bifacial HJT | 1,540 | 38.5 |

LCOE difference: 2% (HJT still wins, but smaller advantage)

Scenario 2: Low albedo (asphalt, 10%)

| Technology | Bifacial Gain | Production (kWh/kWp) | LCOE (€/MWh) |

|---|---|---|---|

| Mono PERC | - | 1,750 | 31.4 |

| Bifacial HJT | +7% | 1,873 | 31.2 |

LCOE difference: 0.6% (almost negligible)

Recommendation: In low irradiance + low albedo zones, standard PERC is sufficient.

9. Technology selection guide

Decision tree

What is your priority?

│

├─ Minimum CAPEX

│ └─► Monocrystalline PERC (LONGi, JinkoSolar)

│

├─ Maximize production in limited space

│ └─► Bifacial HJT (REC, Huasun)

│

├─ Balance production/cost

│ └─► TOPCon (JinkoSolar Tiger Neo, Trina Vertex N)

│

├─ High ambient temperature (> 35°C frequent)

│ └─► HJT (coefficient -0.25%/°C)

│

├─ High albedo (> 30%) + elevated structure

│ └─► Bifacial (PERC or HJT depending on budget)

│

└─ Innovative project / R&D

└─► Tandem perovskite (Oxford PV, if available)Recommendation table by project type

| Project Type | Recommended Technology | Rationale |

|---|---|---|

| Utility-scale > 50 MW | Mono PERC | Volume reduces price, predictable ROI |

| Plants 10-50 MW | TOPCon | Optimal balance |

| Industrial self-consumption | Bifacial HJT | Maximizes kWh/m² on limited roof |

| Plants in Andalusia | Bifacial (PERC or TOPCon) | High irradiance + favorable albedo |

| Plants in Galicia | Mono PERC | Premium efficiency not justified |

| Single-axis tracking | TOPCon or Bifacial PERC | Tracker already optimizes capture |

| Dual-axis tracking | HJT (maximum efficiency) | Tracker captures everything, maximizes conversion |

10. Conclusion: There is no “best” technology

Technology choice depends on your project’s specific context. In 2026:

Universal truths:

- PERC remains the workhorse: 70% of market for its price/performance balance

- HJT is the future: But still with price premium that doesn’t always justify

- Bifacials are worth it if albedo > 20% and elevated structure (ROI < 3 years)

- Perovskite is not commercially viable yet (wait until 2028-2030)

Selection strategy:

- Simulate your project with PVsyst using 2-3 technologies

- Calculate LCOE for each option (not just CAPEX)

- Evaluate risk: Will your manufacturer still exist in 15 years?

- Verify availability: Can you get 10 MW of those panels in your timeline?

The difference between a good and bad choice can be 1-2 IRR points and 15-20% additional production over 25 years.

Need help simulating different technologies for your project? 👉 Use our LCOE calculator by technology

Want benchmarking of plants with different technologies? Explore our real performance database