How to Read a Solar PPA: Key Clauses Every Asset Manager Must Know

Introduction

You’ve spent months developing your photovoltaic project. The permits are approved, the EPC is signed, and the financing is almost closed. Now the bank demands: “We need a PPA to lend 70% of the CAPEX”. You receive an 80-page contract full of legal terms in English, indexation clauses, curtailment penalties, and references to electricity markets you barely know.

Do you sign without more? Call a lawyer? How do you know if that PPA is good or bad for your project?

A Power Purchase Agreement (PPA) is not just an electricity sales contract: it’s the document that will determine your plant’s profitability for the next 10-15 years. A poorly negotiated clause can cost you hundreds of thousands of euros. Favorable indexation can increase your IRR by 2-3 percentage points.

In this article, we’ll break down the critical clauses every asset manager must understand before signing a solar PPA in Spain. You don’t need to be a lawyer, but you must know what questions to ask and which terms are negotiable.

1. What is a PPA and why do you need it?

A PPA (Power Purchase Agreement) is a long-term electricity purchase contract between a generator (your solar plant) and an off-taker (buyer), which can be:

- An energy retailer (Repsol, Endesa, Iberdrola Clients)

- An industrial company with high consumption (factory, data center)

- A renewable energy aggregator

- A renewable trader specialist

Why sign a PPA?

| Advantage | Description |

|---|---|

| Income stability | Fixed or predictable price for 10-15 years |

| Bankability | Banks lend more at lower interest with PPA |

| Price risk reduction | Avoid pool volatility (OMIE) |

| Long-term planning | Facilitates cash flow projections |

When do you NOT need a PPA?

- If you’re an investment fund with high risk tolerance and want to maximize upside in spot market

- If your plant is small (< 5 MWp) and you can handle volatility

- If you have access to active market management tools (trading)

In 2026, approximately 60% of photovoltaic plants in Spain operate with some type of PPA, while the remaining 40% sell directly to the electricity pool.

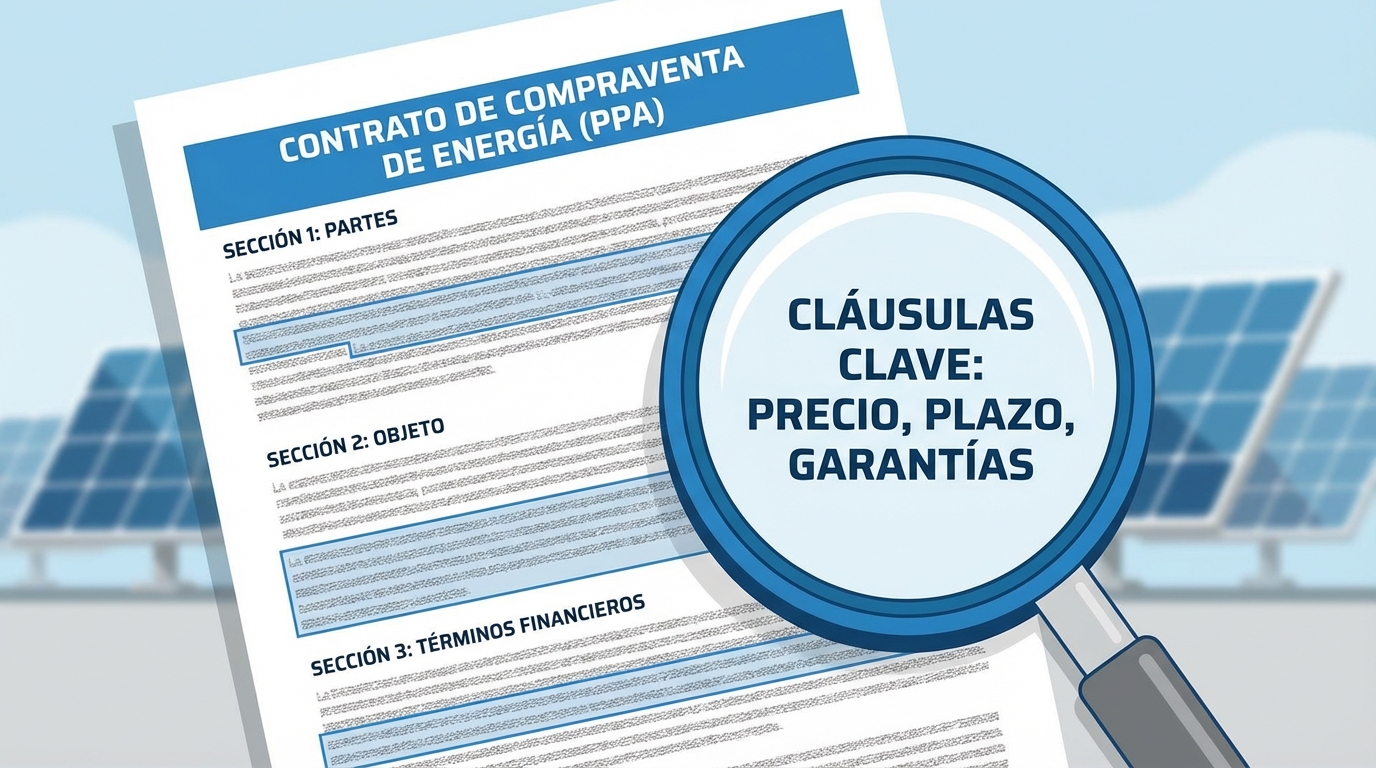

2. Types of PPA: Physical vs Financial

Before analyzing clauses, you must understand what type of PPA you’re signing. There are two main categories:

Physical PPA

- Definition: Your plant delivers physical energy to the off-taker, who handles its commercialization

- Balance responsibility: The off-taker assumes deviations between real and estimated production

- Settlement: You’re paid for delivered energy according to agreed price

- Typical in: Plants > 20 MWp with long-term contracts

Example: Your plant produces 1,000 MWh in January, physical PPA pays 40 €/MWh → Revenue = 40,000 €

Financial PPA (Virtual PPA / Contract for Difference)

- Definition: Your plant sells to pool (OMIE), but off-taker pays you the difference between pool price and PPA strike price

- Balance responsibility: You maintain your own balance management

- Settlement: Settled by differences (can be in your favor or against)

- Typical in: Large corporates (Google, Amazon) who don’t want to manage physical energy

Example:

- Production: 1,000 MWh

- PPA strike price: 40 €/MWh

- Real pool price: 35 €/MWh

- You sell to pool: 35,000 €

- Off-taker pays you difference: (40 - 35) × 1,000 = 5,000 €

- Total revenue: 40,000 €

If pool had been at 50 €/MWh, you pay the difference to off-taker (10,000 €), keeping the 40,000 € from strike.

Which is better?

| Criterion | Physical PPA | Financial PPA |

|---|---|---|

| Simplicity | ✅ Simpler | ❌ Requires more management |

| Market upside | ❌ Don’t participate in peaks | ✅ Partial participation |

| Counterparty risk | 🟡 Moderate | 🟡 Moderate |

| Preferred by banks | ✅ Yes | 🟡 Depends |

Recommendation: If you’re a developer selling the plant to a fund, physical PPA is more valued in the transaction. If you’re an asset manager with trading team, financial gives you more flexibility.

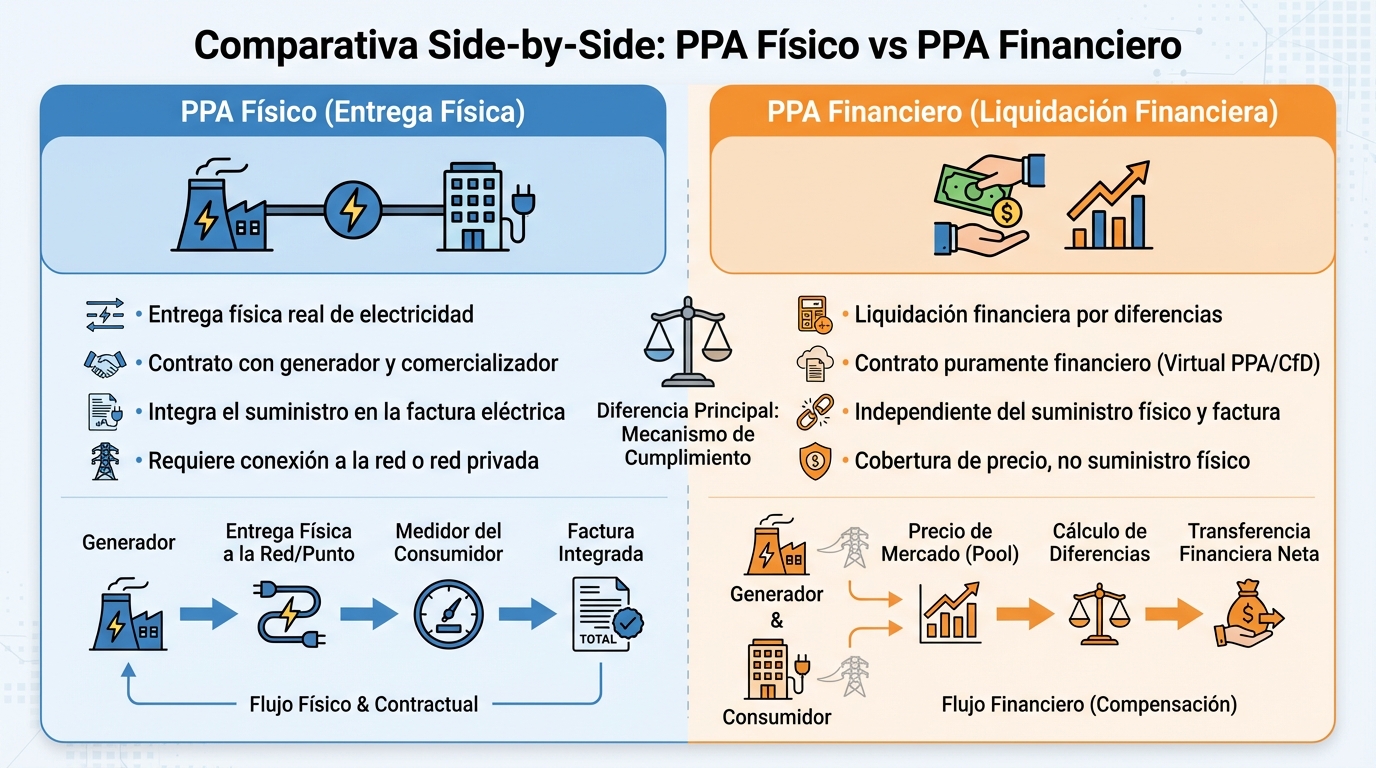

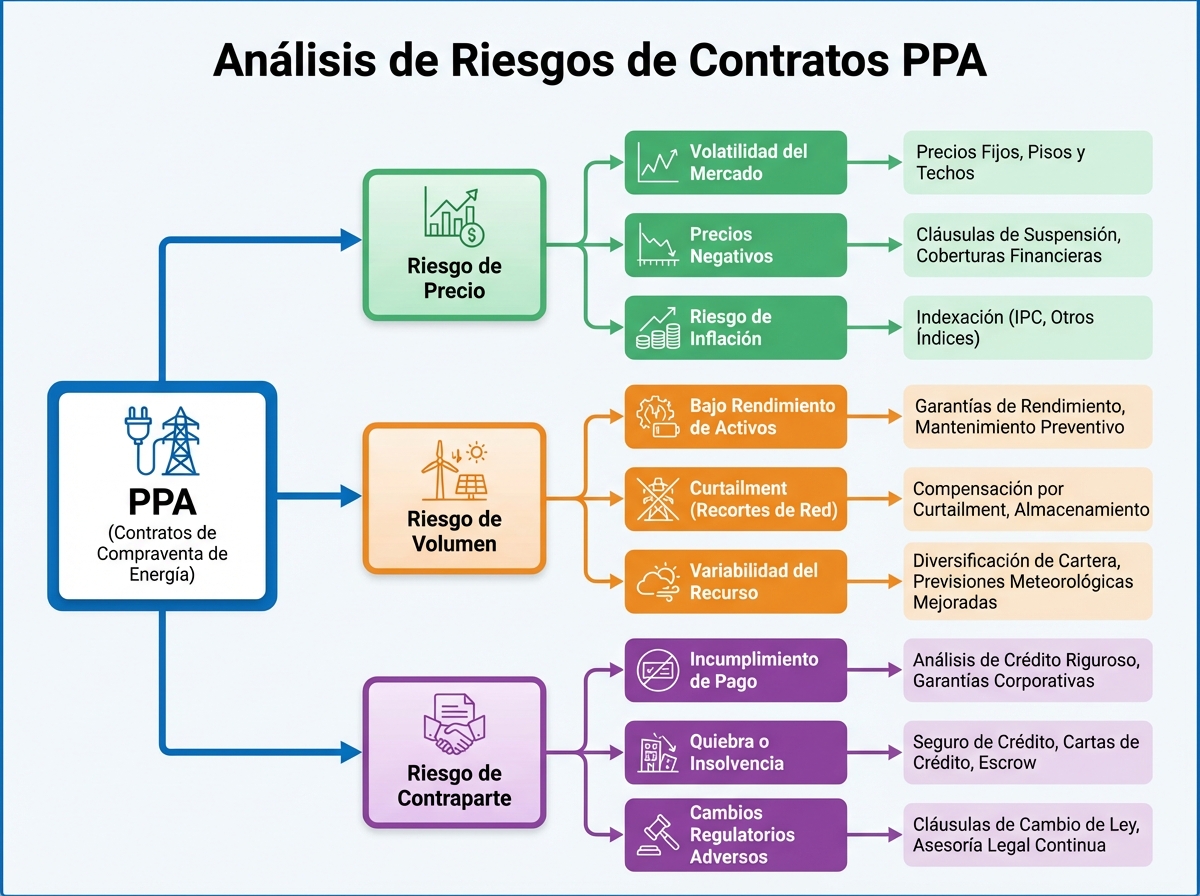

3. Critical price and indexation clauses

Price is what everyone looks at first, but how that price is indexed is equally important.

3.1 Base Price (Strike Price)

- What is it? The price per MWh you’ll be paid (e.g.: 38 €/MWh)

- Is it negotiable? Yes, depends on production profile, location, contract duration

- Typical range 2026: 35-45 €/MWh for 10-12 year contracts

3.2 CPI Indexation

Many PPAs include an annual CPI (Consumer Price Index) indexation clause to protect against inflation:

Example clause:

“The Base Price will be adjusted annually on January 1 of each year according to Spain’s CPI variation from the previous year, with a maximum cap of 3% annually.”

⚠️ Negotiation point:

- Negotiable: If there’s a cap, negotiate a floor too

- Best scenario: Indexation without caps, but off-takers usually resist

- Risk: If contract has no indexation, you lose purchasing power each year

3.3 Production Profile Adjustment (Shape Pricing)

Some PPAs pay different prices depending on time of day:

- Peak hours (10:00-14:00, 18:00-22:00): 42 €/MWh

- Off-peak hours (rest): 36 €/MWh

Advantage: Incentivizes optimizing production toward higher-value hours Disadvantage: More complex to model and audit

3.4 Guaranteed Minimum Price (Floor)

A clause highly valued by investors:

“In case the electricity pool price falls below 30 €/MWh for more than 3 consecutive months, the Buyer guarantees a minimum price of 35 €/MWh.”

Negotiation: This clause is difficult to get without paying an implicit premium (base strike will be lower).

4. Volume clauses: Take-or-Pay vs Pay-as-Produced

Pay-as-Produced (Most common)

- Definition: Off-taker pays only for energy you actually produce

- Risk for generator: If you produce less than estimated (technical failure or low irradiation), you earn less

- Risk for off-taker: If you produce more than estimated, must buy that excess (or allow you to sell to pool)

Take-or-Pay (Less common, more favorable for generator)

- Definition: Off-taker commits to pay a minimum annual volume, whether you produce it or not

- Example: “Buyer will pay for a minimum of 15,000 MWh/year, regardless of actual production”

- Advantage: Total security of minimum revenue

- Negotiation: Only large corporates or solid retailers offer this

Tolerance Bands

A middle ground between both:

“The Generator commits to deliver 16,000 MWh/year with a tolerance of ±10%. If production falls below 14,400 MWh, Generator will compensate the difference at pool price. If it exceeds 17,600 MWh, the excess will be settled at spot price.”

⚠️ Risk: If you sign very narrow tolerance bands and have a low irradiation year (P90), you can end up paying penalties.

5. Curtailment clauses: Who assumes the risk

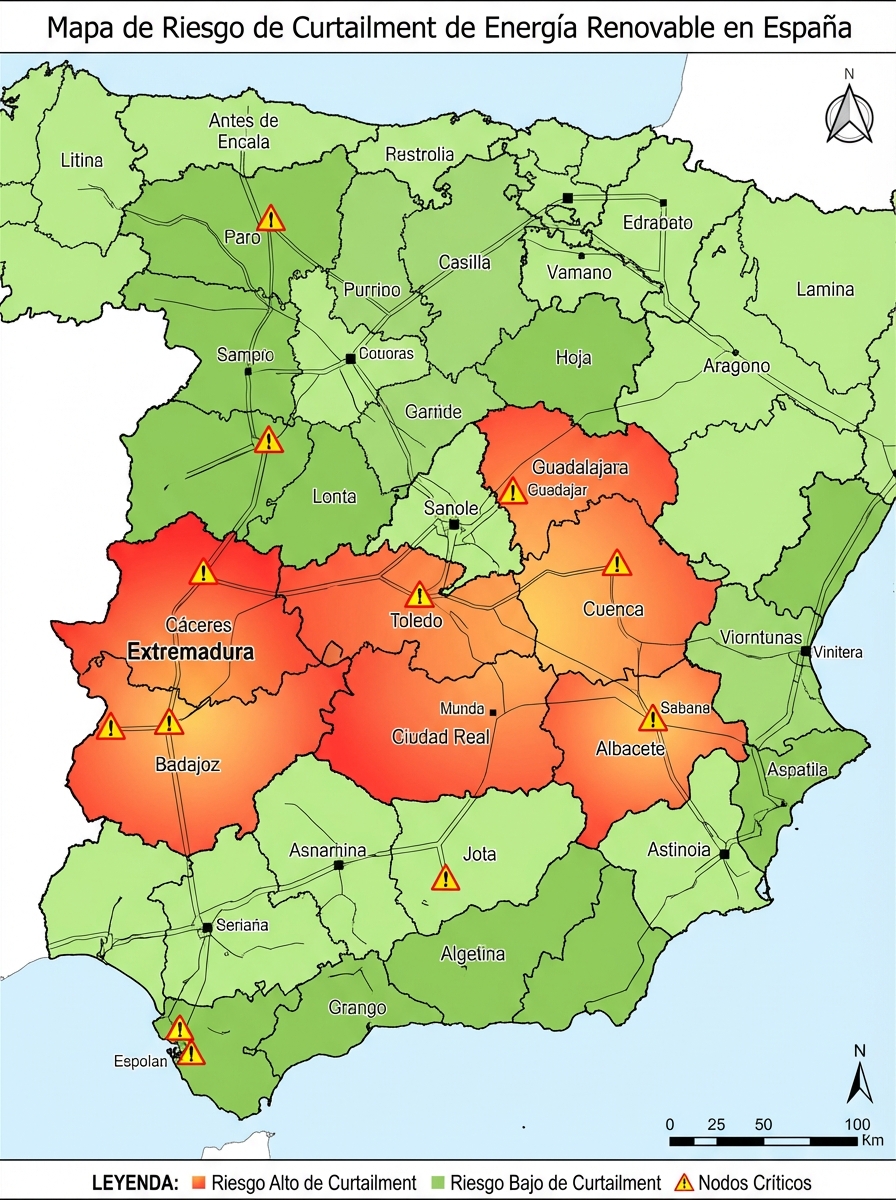

Curtailment (forced production reduction ordered by system operator) is one of the most critical risks in Spain in 2026, especially at saturated nodes in Extremadura and Castilla-La Mancha.

Types of Curtailment

- Technical curtailment: Ordered by REE for grid constraints

- Commercial curtailment: Off-taker asks you to reduce production because pool price is very low (negative)

Who pays for curtailment?

Clause A (Favorable to generator):

“Buyer will assume 100% of losses from technical curtailment ordered by System Operator, paying Generator the PPA price for energy not produced.”

Clause B (Favorable to off-taker):

“Technical curtailment is a Generator risk. Energy not produced due to OS orders will not be compensated.”

Clause C (Compromise):

“Curtailment will be compensated at 50% of PPA price if it exceeds 3% of estimated annual production.”

Negotiation: This clause is critical. If your plant is at a node with curtailment history (> 5% annually), you must negotiate compensation. Otherwise, your financial model is at risk.

6. Off-Taker solvency evaluation

A PPA is only worth what the counterparty signing it is worth. If the off-taker goes bankrupt in year 3 of a 12-year contract, you lose all contract stability.

Off-Taker Due Diligence

Before signing, verify:

| Factor | What to review |

|---|---|

| Credit rating | Minimum BBB- (investment grade). Below this, demand guarantees |

| Financial statements | Review last 3 years of EBITDA, debt/equity ratio, liquidity |

| PPA experience | How many PPAs have they signed? Have there been previous defaults? |

| Bank guarantees | Demand they deposit bank guarantee equivalent to 6-12 months of payments |

Parental Guarantee Clause

If off-taker is a subsidiary of a large corporation:

“The parent company [Name S.A.] jointly guarantees the payment obligations of its subsidiary [Off-taker Ltd.]”

This is gold: If subsidiary goes bankrupt, you can claim from parent.

What happens if off-taker defaults?

Early termination clause:

“If Buyer incurs non-payment for more than 60 days, Generator may terminate contract without penalty and retain deposited bank guarantee.”

Substitution right:

“Generator will have the right to seek a new off-taker without penalty if original Buyer defaults.”

7. Contract duration: 10, 15 or 20 years?

PPA duration directly impacts price and bankability:

| Duration | Advantages | Disadvantages |

|---|---|---|

| 5-7 years | Future commercial flexibility | Lower price, hard to finance |

| 10-12 years | Optimal price/flexibility balance | Market standard |

| 15-20 years | Higher price, maximum bankability | Less flexibility, regulatory risk |

2026 Recommendation:

- For plants > 50 MWp seeking project finance: 12-15 years

- For plants 10-30 MWp with own equity: 10 years with extension option

Extension Option

A smart clause:

“Generator will have the right to extend the contract for 5 additional years, notifying 12 months in advance. Extension price will be renegotiated according to market conditions at that time, with a floor of 90% of last year’s price of original contract.”

This gives you flexibility without being trapped.

8. Regulatory change clauses (Change in Law)

The Spanish energy sector has seen multiple regulatory changes in the last decade (retroactive cuts, new tolls, capacity charges). A good PPA should protect you:

Regulatory Change Clause:

“If a new law or regulation (approved after signing this contract) increases Generator’s operating costs by more than 5%, Parties will renegotiate PPA price to compensate said increase. If no agreement in 60 days, either Party may terminate contract without penalty.”

Examples of regulatory changes that have impacted PPAs:

- Introduction of new grid tolls (2025): +2-3 €/MWh cost

- Capacity charges: Variable impact depending on production profile

- Changes in access and connection: Affect new plants, not operating ones

Negotiation: This clause is difficult to get, but try to at least include a renegotiation mechanism in good terms.

9. Long-term risk modeling

A PPA is not static. You must model different risk scenarios:

Scenario 1: Pool Price > PPA Price

- Situation: You signed PPA at 40 €/MWh, but pool is at 55 €/MWh

- Result with physical PPA: Lose 15 €/MWh upside (but have stability)

- Result with financial PPA: Pay difference to off-taker, but maintained balance risk

Mitigation: Negotiate shorter contracts or with price review clauses every 3-5 years.

Scenario 2: Accelerated Panel Degradation

- Situation: Projected to produce 16,000 MWh/year, but due to rapid degradation produce 14,500 MWh

- Result with Pay-as-Produced: 9.4% lower revenue

- Result with Tolerance Band: Possible penalties

Mitigation: Include panel manufacturer guarantees as part of technical due diligence.

Scenario 3: Off-Taker Bankruptcy (Year 5 of 12)

- Situation: Your off-taker enters bankruptcy proceedings

- Result without bank guarantee: Stop getting paid, lose 7 years of PPA

- Result with bank guarantee + substitution clause: Collect 6 months guarantee and seek new off-taker

Mitigation: Demand annually renewable bank guarantees and substitution clause.

10. Checklist: 20 Questions before signing

Before signing any PPA, answer these questions:

Price and Commercial Conditions

- Is price indexed to CPI? With caps?

- Is there a guaranteed minimum price (floor)?

- Does price vary by time of day (shape pricing)?

- Who pays additional tolls and charges?

Volume and Production

- Is it Pay-as-Produced or Take-or-Pay?

- Are there tolerance bands? What % deviation allowed?

- What happens if I exceed production estimate?

Curtailment and Operational Risks

- Who assumes technical curtailment risk?

- Is there curtailment compensation? At what price?

- What happens in force majeure (fire, flood)?

Off-Taker and Guarantees

- What is off-taker’s credit rating?

- Is there bank or parental guarantee?

- What happens if off-taker defaults on payment?

- Can I substitute off-taker if they go bankrupt?

Duration and Flexibility

- What is contract duration?

- Is there extension option? On what terms?

- Can I terminate early? With what penalty?

Regulatory and Legal

- Is there regulatory change clause?

- What jurisdiction applies in case of dispute?

- Is there arbitration or ordinary trial?

11. Tools to analyze your PPA

Reviewing an 80-page PPA without help is difficult. At PV Maps we offer:

- PPA Simulator: Compare scenarios with/without PPA according to your production profile

- Off-taker risk analysis: Access to ratings and financial data of retailers

- Price benchmarking: Compare your PPA price with market

Need to review your PPA before signing? 👉 Request a contract analysis

Conclusion: A well-negotiated PPA is worth gold

A PPA is not just a paper you sign to satisfy the bank. It’s the contract that will determine if your plant will be profitable or mediocre for the next decade.

Keys to a good PPA:

- Competitive price with CPI indexation without abusive caps

- Curtailment protection in risk zones

- Solvent off-taker with bank guarantees

- Commercial flexibility with reasonable extension or termination options

- Regulatory change clauses protecting you from future normative changes

Don’t be afraid to negotiate. The best deals are those where both parties feel they’ve given up something but gained much more. And if an off-taker is unwilling to discuss critical clauses like curtailment or guarantees, they’re probably not the right partner for the next 12 years of your investment.

Have questions about a specific clause in your PPA? Access the dashboard