Solar Regulation in Spain 2026: Regulatory Changes Affecting Your Plant

Introduction

The Spanish photovoltaic sector has experienced more regulatory changes in the last 5 years than in its entire previous history. Between 2020 and 2026, the regulatory framework has evolved from a system designed for special regime plants (premiums, FiT) to a mature and liberalized market where plants compete on equal terms with other technologies.

However, this maturity has brought complexity: new grid tolls, stricter access and connection procedures, technical restrictions (curtailment), and developing capacity markets. For an asset manager or developer, not staying updated can result in:

- Revenue losses (up to 5-10% from not optimizing according to new regulation)

- Blocked investments (projects without permits due to regulatory non-compliance)

- Penalties (fines for deviations or technical non-compliance)

In this article, we provide an executive summary of photovoltaic regulation in Spain in 2026, highlighting the most recent changes (2024-2026), their impact on existing vs new plants, and concrete operational and commercial adaptation recommendations.

1. General regulatory framework (2026)

Regulatory hierarchy

Photovoltaic Regulation in Spain

│

├── EUROPEAN LEVEL

│ ├── Renewables Directive 2018/2001 (RED II)

│ ├── Electricity Regulation 2019/943

│ └── Grid Code RfG, DCC, SO GL

│

├── STATE LEVEL

│ ├── Law 24/2013 Electricity Sector

│ ├── RD 1183/2020 (Access and Connection)

│ ├── RD 148/2021 (Technical Restrictions)

│ ├── CNMC Circular 1/2021 (Transmission Tolls)

│ └── CNMC Circular 3/2024 (Tolls Update 2024-2026)

│

└── REGIONAL LEVEL

├── Territorial Planning Laws (vary by region)

├── Environmental Impact Statements (EIS)

└── Construction PermitsRegulatory bodies

| Body | Function | Impact on PV |

|---|---|---|

| MITECO | National energy policy | NECP plans, renewable auctions |

| CNMC | Independent regulator | Sets tolls, supervises market |

| REE | System operator (TSO) | Manages restrictions, grid access |

| Distributors | Local grid operators (DSO) | Connection, metering, billing |

| OMIE | Wholesale market operator | Energy clearing in pool |

2. Access and connection: Changes 2024-2026

Historical problem (2018-2021)

Between 2018-2021, Spain experienced a “permit bubble”: 130 GW of access rights were granted (3x total system capacity), creating:

- Saturated nodes: Zones with more MW in permits than evacuation capacity

- Speculative projects: Developers accumulating permits without construction intent

- Massive delays: REE unable to process 10,000+ requests

RD 23/2020 and RD 1183/2020: The reform

Objectives:

- Eliminate speculative permits

- Prioritize projects with real viability

- Introduce binding construction milestones

Key changes:

| Aspect | Before (2018-2019) | After (2020-2026) |

|---|---|---|

| Guarantees | Not required | Mandatory (40-60 €/kW) |

| Binding milestones | Didn’t exist | 3 milestones + penalties for non-compliance |

| Allocation criteria | First-come first-served | Priority criteria (technical, environmental maturity) |

| Permit validity | Indefinite | 4 years (with possible extensions) |

| Compliance audit | No | Yes (REE verifies quarterly) |

Milestone system (current 2026)

For projects > 10 MW:

| Milestone | Deadline | Requirement | Non-compliance Penalty |

|---|---|---|---|

| H1 | 12 months from grant | Prior Administrative Authorization | Loss 25% guarantee |

| H2 | 30 months | Construction Administrative Authorization | Loss 50% guarantee |

| H3 | 48 months | Commissioning (COD) | Loss 100% guarantee + expiry |

Example guarantee:

- 50 MW plant

- Guarantee: 50,000 kW × 50 €/kW = 2.5 M€

- If you miss H2: Lose 1.25 M€

Mitigation strategy:

- Time buffer: Request permits when you have 80% of documentation ready

- Realistic milestones: Don’t request access until you have signed land and favorable EIS

- Performance insurance: Policies exist covering guarantee loss due to administrative delays (cost: 0.5-1% of guarantee)

3. Technical restrictions (Curtailment): RD 148/2021

What are technical restrictions?

Curtailment is REE’s order to reduce your plant’s production due to:

- Grid saturation: More generation than evacuation capacity

- System security: Excess renewable generation (thermal minimum not covered)

- Zonal congestion: Inter-regional transport limitations

Evolution of curtailment in Spain

| Year | GWh Curtailed (PV) | % PV Production | Most Affected Zones |

|---|---|---|---|

| 2021 | 85 GWh | 0.3% | Extremadura, CLM |

| 2022 | 320 GWh | 0.9% | Extremadura, CLM, Andalusia |

| 2023 | 890 GWh | 2.1% | Extremadura, CLM, Andalusia |

| 2024 | 1,450 GWh | 3.2% | + Aragon |

| 2025 | 2,100 GWh | 4.1% | Extension to Murcia |

| 2026 (projection) | 2,800 GWh | 5.0% | All high GHI zones |

Trend: Curtailment grows exponentially as more MW are installed in saturated zones.

RD 148/2021: Compensation framework (or lack thereof)

Current situation (2026):

❌ No economic compensation for technical restrictions in Spain (unlike Germany, Italy)

Implications:

- If REE orders you to reduce production by 1,000 MWh, you lose revenue of 40,000-50,000 € (@ 40-50 €/MWh)

- No indemnification

- Can only mitigate with BESS (store energy that would be curtailed)

Proposal under debate (MITECO 2026):

- Compensation of 80% spot price for curtailed energy

- Would only apply to plants with > 5% annual curtailment

- Status: Under public consultation, expected for 2027

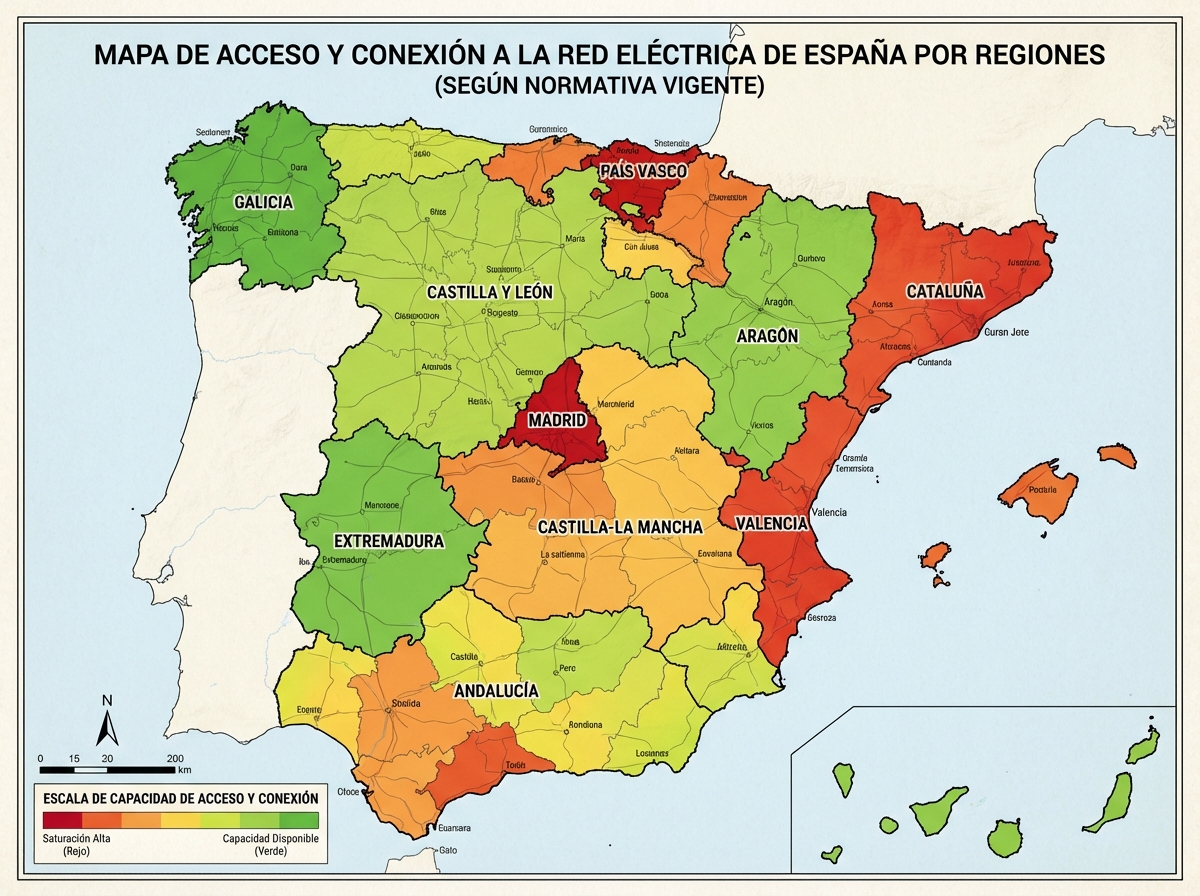

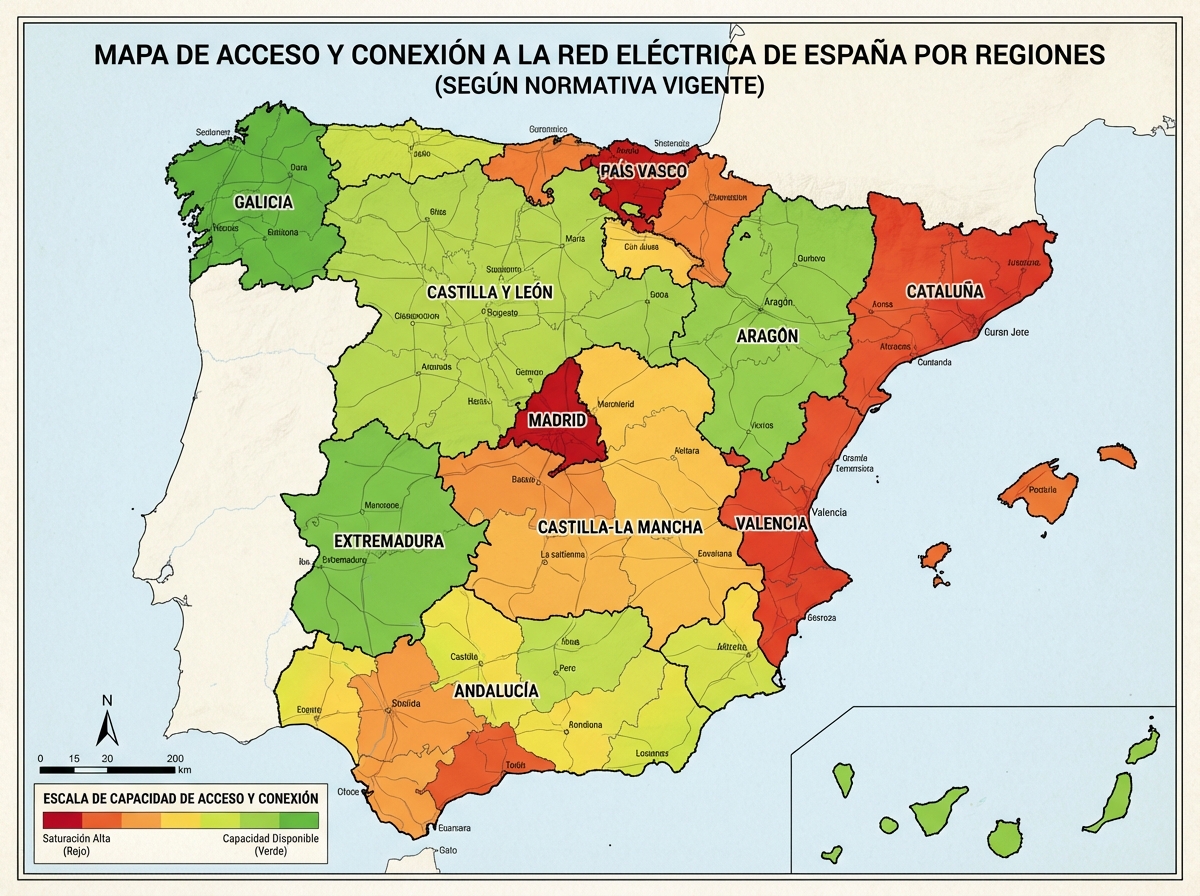

Curtailment risk map by node

High saturation nodes (curtailment > 8%/year estimated 2026):

| Node / Zone | Installed Power | Evacuation Capacity | Saturation | Estimated Curtailment |

|---|---|---|---|---|

| Guillena (Seville) | 3,200 MW | 2,000 MW | 160% | 12-15% |

| Trujillo (Caceres) | 2,800 MW | 1,800 MW | 155% | 10-13% |

| Manzanares (Ciudad Real) | 2,400 MW | 1,600 MW | 150% | 9-12% |

| Escatron (Zaragoza) | 1,900 MW | 1,400 MW | 136% | 6-8% |

Recommendation for new projects: Avoid nodes with saturation > 130% (structural curtailment assured).

4. Grid tolls: CNMC Circular 3/2024

Toll structure (2026)

Tolls are costs for using the transmission (REE) and distribution (distributors) grid. They’re divided into:

| Concept | Description | Who Pays |

|---|---|---|

| Access tolls | Distribution grid use | Consumers |

| Transmission tolls | Transmission grid use (REE) | Generators and consumers |

| System charges | Finance regulated costs (old renewable premiums, tariff deficit) | Consumers |

Changes 2024-2026 (CNMC Circular 3/2024)

New: Introduction of hourly tolls for generators.

Before (2020-2023):

- Fixed toll: 0.5 €/MWh (all generators)

After (2024-2026):

- Variable toll per hour:

- Off-peak hours (00:00-08:00): 0.2 €/MWh

- Peak hours (12:00-16:00): 1.2 €/MWh

- Rest: 0.6 €/MWh

Impact on typical solar plant:

| Period | Production (%) | Toll (€/MWh) | Weighted Cost |

|---|---|---|---|

| Off-peak | 5% | 0.2 | 0.01 €/MWh |

| Peak | 60% | 1.2 | 0.72 €/MWh |

| Rest | 35% | 0.6 | 0.21 €/MWh |

| Total | 100% | - | 0.94 €/MWh |

Increase vs 2023: +88% (from 0.5 to 0.94 €/MWh)

Annual impact (10 MW plant, 17,500 MWh/year):

- Before: 8,750 €/year

- Now: 16,450 €/year

- Increase: 7,700 €/year (-0.5% in net revenue)

Adaptation strategy

- Renegotiate PPAs: If your PPA is pre-2024, try to renegotiate so off-taker assumes incremental tolls

- Optimize curtailment: If ordered to reduce in peak hours (12-16h), you save tolls (small consolation)

- BESS for temporal arbitrage: Store in off-peak (low toll), sell in non-peak hour (avoid high peak toll)

5. Capacity markets: Mechanism in development

What is a capacity market?

A capacity market pays generators for being available (not for generating), ensuring the system has sufficient firm power at demand peaks.

Problem for solar: Solar energy is not firm (doesn’t produce at night), so historically doesn’t participate in capacity markets.

Spanish proposal (2025-2026)

MITECO has proposed a capacity mechanism that would enter into force in 2027-2028 with these characteristics:

| Aspect | Detail |

|---|---|

| Eligible participants | Firm generators (gas, nuclear, hydro) + renewables with BESS |

| Solar capacity calculation | Available power @ 19:00-22:00 (critical hour) |

| Estimated remuneration | 15,000 - 30,000 €/MW/year |

| Minimum requirement | Availability > 90% in critical hours |

Implication for PV with BESS:

- 10 MW plant + 4 MW / 8 MWh BESS

- Recognized firm capacity: 4 MW (what you can deliver 19-22h with charged battery)

- Additional revenue: 4 MW × 20,000 €/MW = 80,000 €/year

Conclusion: Capacity markets improve the business case for hybridization (PV + BESS), making batteries more profitable.

6. Self-consumption: Royal Decree 244/2019 (current, with 2024 modifications)

General framework

RD 244/2019 liberalized self-consumption, eliminating the “sun tax” and allowing surplus compensation.

Current modalities (2026):

| Modality | Description | Typical Use |

|---|---|---|

| Without surplus | Instant consumption, 0 grid injection | Industrial self-consumption with BESS |

| With surplus without compensation | Sell surplus to market (pool) | Plants > 100 kW |

| With surplus with compensation | Bill compensation (€/kWh) | Residential and SMEs < 100 kW |

2024 modification: Compensation limit

Change: Surplus compensation limited to 50% of monthly bill (before: 100%).

Impact:

- Residential installation generating 100 €/month surplus

- Billed consumption: 80 €/month

- Before: 80 € compensation (all consumption)

- Now: 40 € compensation (50% of consumption)

- Loss: 40 €/month = 480 €/year

Official justification: Prevent users with high generation from receiving 0€ bill (don’t pay grid tolls, defunds system).

Adaptation strategy:

- Install small BESS (5-10 kWh residential) to self-consume more and inject less

- Redesign installed power: Install only what’s needed to cover consumption (don’t oversize)

7. Environmental changes: Law 7/2021 Climate Change

Protection distances (expanded 2024)

Objective: Protect biodiversity and cultural heritage.

New restrictions:

| Protected Zone | Minimum Distance | Before (2020) |

|---|---|---|

| Natura 2000 Network Spaces | 2 km | 500 m |

| Livestock routes | 100 m | No restriction |

| Cultural Heritage Sites (BIC) | 5 km | 1 km |

| ZEPA Zones (Birds) | 3 km | 1 km |

Impact: 20-30% of previously eligible land has been excluded.

Strategy:

- Early verification: Use MITECO viewer before signing leases

- Preemptive biodiversity studies: Anticipate environmental objections with independent studies

Mandatory environmental compensation (since 2024)

Plants > 10 MW must allocate 1-2% of CAPEX to compensatory measures:

- Reforestation of degraded zones

- Creation of ecological corridors

- Local conservation funds

Typical cost: 50,000 - 150,000 € for 50 MW plant

8. Impact on existing vs new plants

Comparative table

| Regulatory Change | Impact Existing Plants | Impact New Plants |

|---|---|---|

| Hourly tolls (2024) | ✅ Applies immediately | ✅ Applies from COD |

| Access/connection milestones | ❌ Doesn’t apply (grandfathering) | ✅ Mandatory compliance |

| Environmental restrictions | ❌ Not retroactive | ✅ Strict compliance |

| Capacity markets (2027) | ✅ Opportunity (with BESS) | ✅ Optimized design |

| Curtailment compensation (2027 proposal) | ✅ If approved, applies | ✅ If approved, applies |

Key conclusion: Existing plants are protected (grandfathering) from permit changes, but not from operational cost changes (tolls, restrictions).

9. Adaptation recommendations

For asset managers of existing plants

1. Audit your exposure to new tolls

- Calculate hourly toll impact on your P&L

- If significant (> 2% revenue), consider renegotiating PPA or selling energy in non-peak hours

2. Evaluate BESS retrofit

- If curtailment > 8%/year, BESS business case improves with:

- Capture of curtailed energy

- Future capacity market revenue (2027+)

3. Monitor regulatory changes

- Subscribe to CNMC, MITECO newsletters

- Participate in public consultations (influence future regulation)

For developers of new projects

1. Prioritize non-saturated nodes

- Avoid zones with saturation > 130%

- Accept lower irradiance if reducing curtailment risk (ROI can be better)

2. Design with regulatory flexibility

- Infrastructure prepared to add BESS (spaces, wiring)

- Conservative DC/AC ratio (1.25-1.30) to minimize clipping that could be curtailed

3. Budget for environmental compensations

- Budget 1-2% additional CAPEX from day 1

- Integrate environmental measures in design (agrivoltaics, wildlife passages)

For investors

1. Exhaustive regulatory due diligence

- Verify milestone compliance (permit expiry risk)

- Audit historical and projected curtailment exposure

- Validate environmental compensations are paid

2. Model regulatory scenarios

- Base case: Current regulation

- Optimistic case: Curtailment compensation approved

- Pessimistic case: Tolls +50%, curtailment +5pp

3. Adjust valuation

- 5-10% discount in high regulatory risk zones

- 3-5% premium on plants with low exposure to future changes

10. Conclusion: Stable but evolving regulation

The photovoltaic regulatory framework in Spain has reached relative stability in 2026 after years of intense changes (2020-2024). However, it’s not a static framework:

Expected changes 2026-2028:

- Capacity markets (2027): Will improve BESS business case

- Curtailment compensation (2027-2028): Will reduce investment risk in saturated zones

- Dynamic tolls (2028): Possible introduction of real-time tolls (nodal pricing)

- Environmental restrictions (ongoing): Will continue tightening

Keys to navigate regulation:

- Stay informed: Regulation changes every 12-18 months

- Diversify risk: Don’t concentrate portfolio in single zone (regulatory and technical)

- Design with flexibility: Prepare assets to adapt to future changes

- Participate in public consultations: Industry can influence favorable regulation

Regulation should not be seen as an obstacle, but as a game framework that, well understood, allows optimizing profitability and reducing risks.

Need regulatory advice for your project? 👉 Contact consultants specialized in PV regulation